After I paid off my student loans, it was time for me to start getting serious about my savings. In the enlightened spirit of making money work for me, I have decided on high yield-savings account.

Lets dive into the ins and outs of why and how to choose the right high-yield savings account.

What is a high yield savings account?

An account where interest actually supports your money growth. High yield savings accounts are savings vehicles that earn higher interest rates than the regular, everyday savings accounts.

Where a traditional savings account can offer interest rates as low as 0.01%, high yield savings accounts can offer interest rates as high as 1.05%.

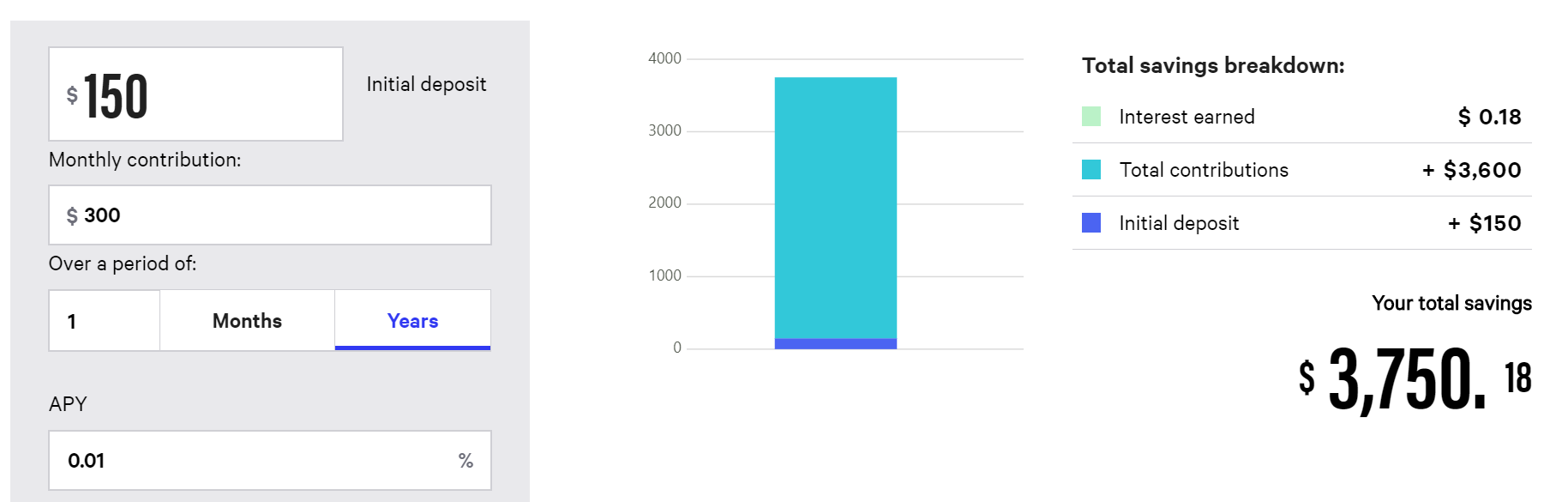

In real life that looks like this:

Traditional Savings:

A $150 initial deposit x $300 recurring monthly deposit for one year = $3, 750.18

High Yield Savings:

A $150 initial deposit x $300 recurring monthly deposit for one year = $3, 768.87

So, the main difference between a traditional and high yield savings account is the fact that you get a little bit more in return on your investment (a whopping $18.69 more in this case).

IMPORTANT NOTE: A high yield savings account will NOT make you rich (hence my sarcastic comment above). Your money makes money while sitting in the bank but clearly from the example above, not enough that you can start living large.

Your high yield savings account acts a motivator, more or less, to put away money for emergencies or long term goal purchases.

What to look for in choosing the a high yield savings:

When choosing the best high yield savings account for you, you’ll want to consider:

How readily accessible does the money in your savings need to be?

Do you prefer online or in-person banking?

How often do you intend to withdraw from your savings?

Signs of a highly beneficial high yield savings account: for the person with no savings and looking to build one up

No or low minimum to open an account

No monthly fees

No or low monthly balance

FDIC Insured (insurance on your deposit provided by Federal Deposit Insurance Corporation)

Link to a checking account with another bank

Mobile app

Top tier APY for all balances

Signs of a less beneficial high yield savings account: for the person with no savings and looking to build one up

High minimum to open an account

Monthly maintenance fee

Monthly fee for a minimum balance under designated threshold

Competitive APY

No ATMs or brick-and-mortar locations

No mobile app

You’d have to understand your purpose of opening a savings account in the first place to decide which bank you’d like to open a high yield saving account with.

For example, some banks may offer a higher APY (which is an important factor) but may not be easily accessible for withdrawals.

If you're willing to put your money in a savings account that wouldn’t be touched for a long period of time (several years), consider a certificate of deposit (CD) instead of a high yield savings account. Some online banks have CD rates around 1%.

By choosing a high yield savings account that offers a high APY and best meets both your long terms and short term goals, you are putting yourself in a positive financial place.